Getting yourself a car in Nigeria has never been both more challenging and more achievable than it is today.

With the continuous rise in car prices, fluctuating exchange rates, and the growing need for personal mobility, more Nigerians are exploring auto loan and car financing options in 2026 as realistic ways to own a vehicle, especially through affordable car loans offered by some of the best car loan companies providing flexible car loan Nigeria programs.

Yet, many people still hold back, believing that car financing is only reserved for the wealthy or government workers, but that’s far from the truth. In reality, taking a loan for a car has become a common and practical step for many working Nigerians and even a viable car loan for newcomers who are just beginning to build their financial footprint.

Even if you’re a salary earner, entrepreneur, or freelancer, there are genuine ways to get a car in Nigeria through flexible financing if you know where to look, what to compare, and how to avoid the hidden traps that often discourage first-time buyers searching for affordable car loans or reliable car loan Nigeria options.

In this guide, we’ll break down everything you need to know about securing the best car loan rates in Nigeria in 2026 and how to identify the best car loan companies offering transparent terms.

You may not even need a hefty amount for down payment ready for you to be eligible for these options, especially with modern car financing options designed to make taking a loan for a car easier for everyday buyers.

This post is your complete roadmap to owning a car without financial stress by helping you understand the top lenders, interest rates, and where to find affordable car loans, while also learning the smartest negotiation tips when applying for a car loan in Nigeria.

Why Many Nigerians Avoid Auto Loans

Even though auto financing is a global norm, most Nigerians still prefer to pay for cars upfront often emptying their savings or selling valuable assets just to own one.

Why does this happen? The answer lies in fear, misinformation, and past negative experiences with lenders. Let’s break things down and separate facts from myths.

Myth: “Car loans are only for government workers or elites.”

While that used to be the case years ago, things have changed so it is false nowadays.

Today, several microfinance banks, fintech platforms, and online lending startups offer auto loans to small business owners, traders, and private-sector employees.

Though interest rates might be slightly higher than what commercial banks offer, these lenders make financing more inclusive and accessible especially for people outside the traditional banking circle.

Myth: “Interest rates are too high, it’s better to buy with cash.”

Partly true, but context matters. In 2026, the average auto loan interest rate in Nigeria ranges from 18% to 28% per annum, depending on factors like the lender, loan tenure, car type, and your credit profile.

However, when you compare that to the loss in value from inflation or currency depreciation, financing can actually be a smarter option especially if it allows you to start using the car for business, ride-hailing, or daily mobility sooner rather than later.

Challenge: Lack of credit history or formal income proof

Many Nigerians still operate outside the formal banking system, making it difficult for lenders to assess their ability to repay.

Without payslips, tax records, or steady bank statements, loan approval can be tough.

But thanks to innovation, several fintech lenders now use alternative credit scoring systems like analyzing BVN activity, mobile transaction patterns to determine creditworthiness.

This shift is opening new doors for informal workers and entrepreneurs.

Challenge: Hidden charges and unclear terms

Not all lenders are transparent. Some hide insurance costs, processing fees, or vehicle valuation charges in the fine print, only for borrowers to realize the real cost much later.

That’s why it’s crucial to calculate the total cost of borrowing before signing any agreement.

In this guide, you’ll learn how to spot red flags, estimate true repayment amounts, and compare lenders so you can make the best financial decision with confidence.

Not all “loan agents” are genuine, you may also want to check our guide on Avoiding Car Scams in Nigeria

Types of Auto Financing in Nigeria (2026)

Auto financing in Nigeria is evolving rapidly for a wide range of individuals like the salary earners, entrepreneurs, or even freelancers.

You now have multiple pathways to own a car without paying the full amount upfront.

The right option for you depends on your income source, employment type, and car preference (new or used).

Here’s a breakdown of the major auto financing models available in 2026:

Commercial Bank Auto Loans

Commercial banks such as GTBank, Access Bank, FCMB, and First Bank remain key players in Nigeria’s auto finance space.

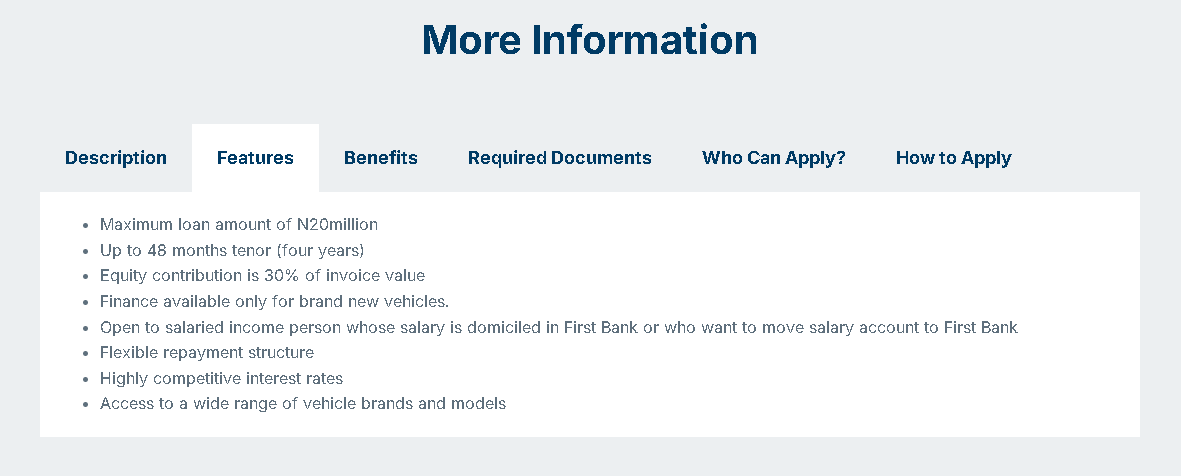

First bank for instance offers up to N20 million with repayment spread up to 4 years but for brand new cars and only restricted to salary earners

These banks typically partner with authorized car dealers to offer loans for brand-new vehicles.

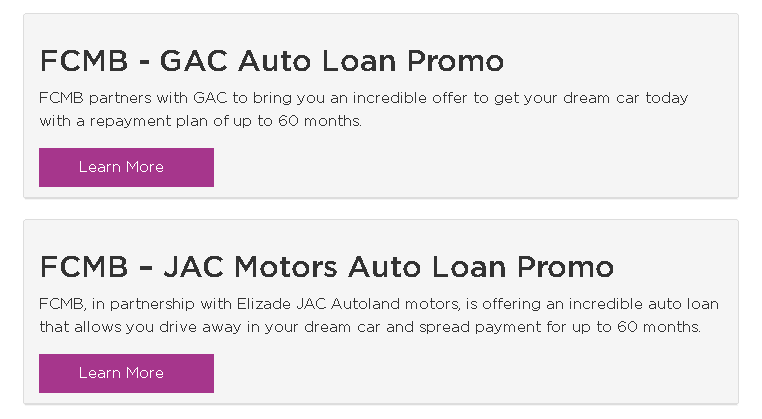

A good example is First city monument bank (FCMB) partnering with GAC Autos together with Elizade JAC Autoland motors to make getting your dream car easier

These commercial banks typically offer loan tenors ranging from 12 to 60 months, with interest rates between 18% and 24% per annum, and a required down payment of 20% to 30% of the car’s value, depending on the specific bank.

Pros:

- Stable and predictable repayment plans

- Often includes insurance and vehicle registration

- Access to reputable dealers and quality vehicles

Cons:

- Usually restricted to brand-new cars

- Lengthy approval process and strict documentation

- Requires formal employment and verified income

GTBank Maxplus offers you a larger loan facility and greater flexibility of up to ₦50 million, repayable in 60 months which you can easily use to finance your dream car and pay back little by little until liquidation

Additionally, Access Bank Car Loan gives up to ₦70 million for Pre-owned vehicles and up to ₦200 million for Brand-new vehicles

They’ve also works with partners like CIG Motors and Coscharis to finance selected car models.

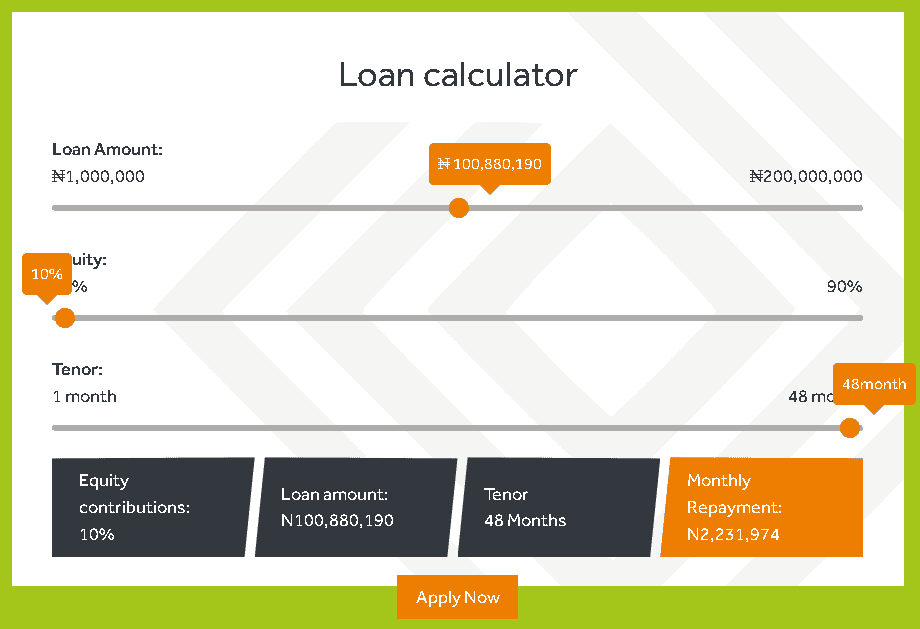

Here’s what their loan calculator looks like so you can compare loan amount against the monthly repayment figure over a period of two years max.

Check out this post where we compiled the list of all the top commercial banks that give car loans in Nigeria

Dealer or Manufacturer Financing

Some car dealers and distributors now offer in-house financing or hire-purchase plans, making it easier to get a car directly from the showroom without a bank loan.

Prominent players include CIG Motors, PAN Nigeria, and Toyota Nigeria.

The structure typically is that you deposit as low as 30% then spread the balance into a monthly repayment plan for up to three years.

The advantage of these dealer financing is that approval is quick and requires fewer documentation and processes.

However, on the flip side, some car dealers inflate the car actual value to hide higher financing costs.

So we always advise you to compare the total repayment amount with the car’s actual value to avoid overpaying by millions.

Microfinance Bank Auto Loans

Microfinance institutions such as Page Financials, LAPO Microfinance Bank, Omiye MFB, and Fina Trust, are now offering car loans tailored for self-employed individuals, SME owners and civil servants.

They also finance used cars, which makes them more flexible than commercial banks.

Their loan Tenor can range between twelve to thirty six months with interest rate ranging from 24%–30% per annum (varies by risk profile)

For the collateral part, more often than not, the vehicle itself or maybe a guarantor or both.

Pros:

- Faster processing time

- Open to self-employed applicants

- Financing for both new and used cars

Cons:

- Higher interest rates

- May include additional charges for insurance or asset verification

Peer-to-Peer & Fintech Auto Financing

Peer-to-peer (P2P) and fintech auto-financing in Nigeria combine online marketplaces and digital lenders to speed up car loans and reach customers that traditional banks often exclude.

Fintech lenders (and some P2P platforms) can approve small-value loans in minutes or hours via app-based underwriting, though larger, fully funded P2P auto loans or dealer-partner packages may take days as investor funding is arranged.

A new wave of fintech-driven lenders like FairMoney, Carbon, and Branch are exploring asset-backed or digital auto loans.

These platforms offer quick, short-to-medium-term financing where your car can serve as partial collateral.

Loan approval typically takes about less than a week, with repayments made weekly or monthly through mobile apps.

These financing options are designed for tech-savvy users with strong digital footprints, offering convenience and quick access to credit.

However, before applying, borrowers should verify that the lender is licensed by the Central Bank of Nigeria (CBN) to avoid scams or predatory terms, and carefully read the fine print—especially regarding default penalties and repossession rights.

Do you plan on buying an affordable car that is loan-friendly? check our Top 7 Cheapest Used Cars in Nigeria (2026).

Eligibility & Documents Required (Credit Score, Salary, Guarantors)

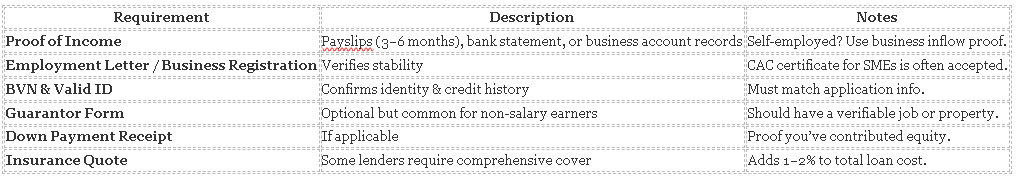

Every financing source has different criteria, but most Nigerian lenders ask for these core items in 2026:

For max result on the probability of approval, you may want to keep your bank inflows steady for at least 3 months before applying because lenders prioritizes account behavior more than current balance on the account

Example — Realistic Approval Snapshot

Applicant: Salary earner, ₦300,000/month

Car price: ₦5 million

Down payment: 25% (₦1.25m)

Loan amount: ₦3.75m

Tenor: 36 months

Interest rate: 20%

Approx. monthly repayment: ₦125,000

That’s 41.7% of monthly income which most banks see as borderline acceptable.

Some microfinance lenders accept up to 50% debt-to-income ratio.

How to Compare Interest Rates, Tenure, and Hidden Charges on Auto Loans in Nigeria

Not all car loans are created equal. Two lenders may both advertise “20% interest,” yet one could end up costing you over ₦600,000 more.

The reason is simple: hidden fees, insurance costs, and how interest is calculated all affect the true price of your loan.

To find the best auto loan deal, you need to understand four key factors lenders use:

1. Nominal vs. Effective Interest Rate

Nominal rate is what banks advertise, for example 18% per year.

Effective rate is the real cost, including processing fees, documentation charges, insurance, and compounding interest.

For instance, Bank A offers an 18% rate but adds ₦200,000 documentation and ₦150,000 insurance fees.

Bank B offers 20% with no extra fees.

Even though Bank B’s rate is higher on paper, it’s may actually be the cheaper option overall depending on the loan amount.

2. Flat Rate vs. Reducing Balance

Flat rate simply means that the interest you pay will be on the full loan amount throughout the loan period

Reducing balance on the other hand means you pay interest only on the remaining balance after each payment. t

The reducing balance option costs less over time as you liquidate the loan.

3. Loan Tenure — How Long Should You Borrow For?

Your loan tenure (the repayment period) plays a major role in determining how much you’ll ultimately pay for your car.

It’s not only about affordability each month but also about the total cost of ownership over time.

Longer Tenure (3–5 years) gives you smaller monthly payments, making it easier to manage your salary and other expenses.

However, the longer you borrow, the more interest you’ll pay overall. For example, a ₦4 million loan over 4 years might cost ₦6.8 million in total.

With shorter Tenure (1–2 years) on the flip side, You’ll face higher monthly payments, but you’ll save a lot on interest in the long run.

A ₦4 million loan over 2 years may cost just ₦5.2 million total, a massive ₦1.6 million difference.

Dreamcar tip: If your income is stable, go for a shorter tenure or make larger periodic payments to reduce your loan faster.

It’s one of the smartest ways to save money on auto financing in Nigeria.

4. Hidden Charges – The Silent Budget Killers

Many Nigerians focus only on the interest rate, but hidden charges can quietly inflate your loan cost by hundreds of thousands of naira.

Always request a comprehensive loan breakdown before signing any agreement.

- Administrative Fees: One-time charges by the bank or finance company for processing your application. It can range from ₦10,000–₦50,000 depending on the lender.

- Documentation Charges: These include paperwork, legal verification, and account setup costs. Some lenders may disguise this as a “stamp duty” or “service fee.”

- Compulsory Insurance Bundling: Some lenders require you to buy comprehensive insurance through their partner companies. While convenient, these packages are often 10–20% more expensive than independent insurance providers.

A good tip is that you ask if you can source your own insurance and provide proof of coverage instead. It’s perfectly legal and can save you money upfront and annually.

Big Down Payment vs. Longer Tenure, What’s Smarter for Nigerian Car Buyers?

One of the toughest decisions when financing a car in Nigeria is whether to make a big down payment or choose a longer repayment tenure.

Both approaches have pros and cons — the right choice depends on your income stability, savings strength, and financial goals.

Why Down Payment Matters

A down payment is the amount you pay upfront before your loan begins. It instantly reduces the principal loan balance, which means less interest over time.

In Nigeria, most lenders require between 20% to 40% down payment depending on your credit profile and the car’s value.

Higher down payment (30%–50%) reduces total loan cost, improves approval chances, and often qualifies you for lower interest rates.

Lower down payment (10%–20%) keeps your savings intact but increases your total loan burden and may attract stricter loan terms.

Let’s paint a quick pic of a ₦5 Million Car

For the first option, you pay ₦2M down, finance ₦3M for 3 years at 20% annually so that every month, you pay ₦115,000, Total: ₦6.14M at the end of the loan tenure

But in the other option, you have to pay ₦500k down, finance ₦4.5M for 3 years at same 20% monthly so that you pay ₦130,000 monthly, the total is ₦6.72M

While Option B seems easier monthly, you end up paying over ₦1 million extra in interest. A larger down payment significantly reduces your total debt burden.

Financing for Used or Imported Cars: Red Flags to Watch

Used and imported vehicles, popularly called Tokunbo cars, make up the majority of car purchases in Nigeria.

They are often more affordable and readily available than brand-new models, but when it comes to financing them, buyers face a unique set of challenges.

Lenders tend to approach Tokunbo car loans with caution because of issues surrounding depreciation, vehicle age, and accurate valuation.

One of the most common problems in this segment is overstated valuation.

Some dealers artificially inflate a car’s price to help the buyer qualify for a larger loan, which results in the borrower paying more interest than necessary.

For this reason, it’s essential to cross-check market value and confirm that the valuation presented to the bank reflects the vehicle’s actual worth.

A good starting point is to compare listings on multiple car platforms or consult independent assessors before signing any agreement.

Another critical red flag is unverified vehicle history. Many imported cars arrive with unclear ownership records, accident histories, or tampered odometer readings.

Lenders are increasingly aware of this risk and may reject applications for vehicles that cannot be traced or authenticated.

Before applying for financing, ensure you run a proper VIN check through reputable databases such as Carfax or AutoCheck.

This step doesn’t just reassure lenders, it protects you from long-term financial and mechanical problems.

Insurance costs are another factor that often surprises borrowers.

Used and imported cars typically attract higher insurance premiums because replacement parts can be harder to find, and the perceived risk of breakdown is higher.

Comprehensive insurance, which is usually mandatory for financed cars, can therefore add a significant recurring cost to your monthly payments.

Calculate this additional expense into your total budget to avoid repayment stress later on.

In Nigeria’s auto loan and financing sector, traditional banks remain selective about used car loans, especially for vehicles older than five years.

However, microfinance institutions and peer-lending platforms have become more flexible in this space, offering borrowers alternative routes to ownership.

While these channels can provide faster approval and less stringent requirements, they often come with higher interest rates to offset the perceived risk.

Comparing offers from multiple lenders using onlinen auto loan calculators can help you identify the most reasonable deal without overextending your finances.

Ultimately, financing a used or imported car in Nigeria requires that you make your due diligence.

Beyond getting loan approval, you must be sure that the vehicle is genuinely worth financing.

A transparent valuation, verifiable history, and reasonable insurance cost should all align before committing to repayment terms.

Tips to Negotiate Better Financing, Refinance, or Pay Off Early

Negotiating the terms of an auto loan in Nigeria is about ensuring the total cost of the loan aligns with your long-term financial comfort.

Many first-time borrowers assume that interest rates are fixed, but in reality, there’s often room to negotiate, especially when you present yourself as a low-risk, credible customer.

Lenders are more willing to offer better terms when they see proof of stable income, consistent account activity, and a history of responsible financial behavior.

The negotiation process usually begins before the loan application is finalized. A smart approach is to get pre-approved by one or more lenders.

This not only gives you an idea of your credit standing but also strengthens your position when talking to dealers or banks.

When a bank knows that another institution has already approved you for a car loan, they may be inclined to match or beat that offer to retain your business.

Presenting salary slips, employment verification, and proof of existing obligations like rent or utility bills helps the lender assess your repayment capacity more confidently, often leading to lower interest rates or flexible repayment schedules.

Once your loan is active, you want to maintain open communication with your lender.

If your income improves or you receive additional funds, consider using that opportunity to make partial lump-sum payments toward the principal.

It can significantly reduce the total interest paid over the life of the loan.

However, before making any early repayments, confirm whether your lender charges an early settlement fee, a clause common in many Nigerian bank loans.

In some cases, this fee might offset the benefits of early payment, so it’s important to calculate carefully before proceeding.

Refinancing is another strategy that can help you save money in the long run.

If you notice that current market interest rates are lower than when you initially took your loan, you can approach another financial institution for a loan refinance.

Refinancing replaces your existing loan with a new one under better terms, allowing you to reduce monthly payments or shorten the repayment period.

While not all Nigerian lenders actively promote refinancing, many are open to it for borrowers with good repayment history and solid employment records.

But them make sure the new loan’s fees and administrative costs don’t cancel out the savings you expect from a lower rate.