If you’ve been dreaming about owning a car but don’t have the full amount upfront, a car loan can help you get behind the wheel sooner.

You have to be smart with your finances and choose the right way to fund your dream ride.

With vehicle prices rising sharply due to exchange rate fluctuations, import duties, and inflation, more Nigerians are turning to auto loans from commercial banks as a practical and sustainable route to own a car.

Rather than waiting years to save up or draining your business capital, a well-structured car loan offer lets you spread payments conveniently over time while you enjoy the comfort and mobility you need today.

Many Nigerian banks now offer flexible auto loan schemes designed to make car financing easier for salary earners, business owners, and professionals.

The key is knowing which banks truly offer the most reliable, transparent, and flexible car financing options in Nigeria.

In this expert-curated guide, I break down the top commercial banks that currently offer auto loans in Nigeria

I’ve also highlighted their loan limits, interest rates, eligibility criteria, and repayment terms.

You’ll also learn how to qualify faster, avoid common pitfalls, and compare offers like a pro before signing any agreement.

Be it that you’re a salary earner planning to buy your first car, a business owner, or a smart buyer looking for the cheapest car deals in Nigeria, this 2026 guide will help you find the bank that fits your budget, lifestyle, and long-term financial goals.

By the end, you’ll know exactly which Nigerian banks are worth approaching and how to turn that dream car into a practical reality.

Top Commercial Banks in Nigeria That Give Auto Loans

Below are some of the top commercial banks in Nigeria that make it possible to finance your dream car and pay conveniently over time without draining your savings.

Access Bank Plc

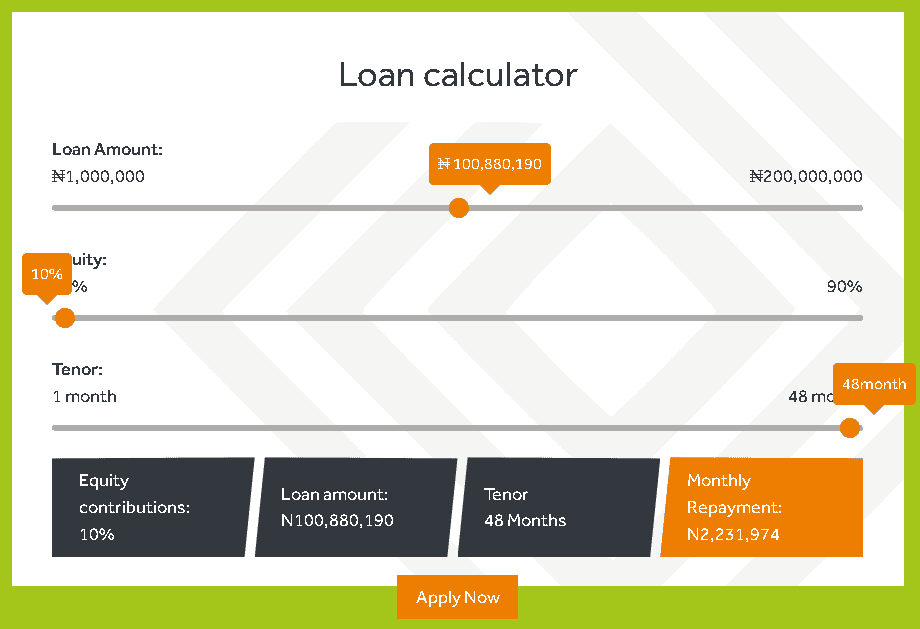

Access Bank’s comprehensive Auto Loan help you acquire brand-new or pre-owned vehicles in a financially convenient manner.

This loan package offers flexible financing that fits both salaried individuals and business owners.

You can access up to ₦70 million for pre-owned vehicles and as much as ₦200 million for brand-new cars, depending on your needs.

The bank makes car ownership simple by requiring as little as 10% equity contribution on the vehicle’s invoice value.

Repayment is also flexible, with a tenor of up to 48 months, giving you enough time to conveniently spread out your payments without financial strain.

Plus, you get to choose from a wide variety of Access Bank–approved dealers, ensuring quality and peace of mind with every purchase.

For women-owned businesses and female salary earners, there’s even more to smile about, special interest rates are available to encourage inclusivity and support.

Beyond that, Access Bank offers competitive interest rates for all borrowers, along with the option to finance annual vehicle maintenance and registration costs.

The pre-liquidation option is allowed without any penalty, giving you the freedom to pay off your loan whenever you’re ready.

Who Can Apply?

Both salary earners and business owners are eligible to apply for the Access Bank Auto Loan.

The process is transparent, customer-friendly, and supported by experienced bank-approved dealers.

Required Documents

For Individuals:

- Completed Vehicle Finance Application Form

- Pro forma invoice addressed to “Access Bank/Customer’s Name”

- Valid means of identification

- Staff ID (for salaried applicants)

- Credit checks

For Businesses:

- One (1) year bank statement (for accounts held with other banks)

- Two (2) years audited financials or management accounts for transactions above ₦50 million

To apply, you can have access to the Access bank auto loan here and show your interest by filling the form or visit the nearest access bank to you.

First Bank of Nigeria

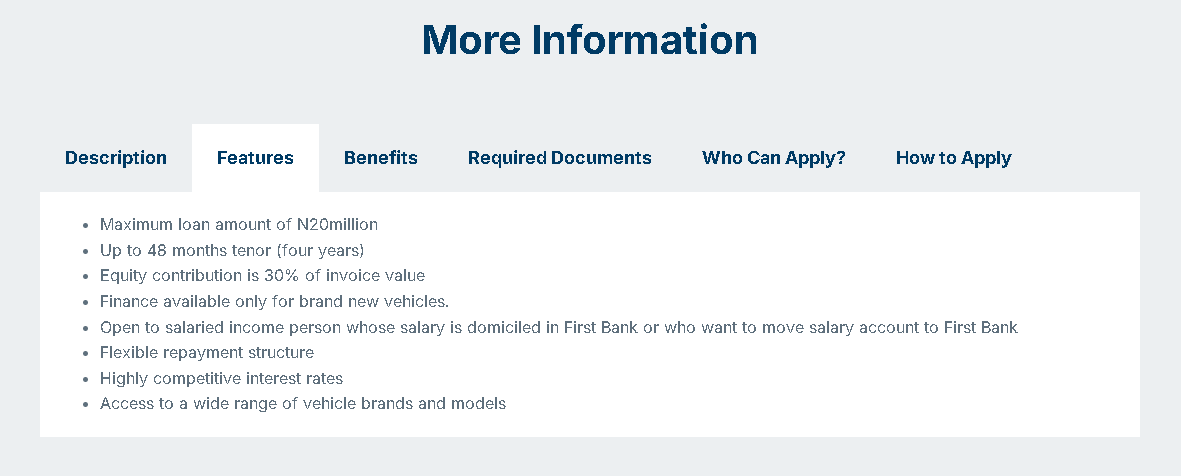

The FirstBank’s Automobile Loan product makes it easy for salaried employees to own a brand-new vehicle without draining their savings.

With flexible repayment options and a competitive interest rate, FirstBank gives you the financial support to buy your dream car confidently.

The FirstBank Auto Loan is open to salaried individuals whose salary is domiciled with FirstBank or who are ready to move their salary accounts to the bank.

It’s a facility designed strictly for brand-new cars, giving you access to top vehicle brands and models from reputable, pre-approved vendors.

To qualify, you’ll need to contribute 30% of the car’s invoice value as equity.

The loan can go up to ₦20 million, with a repayment period of up to 48 months (4 years), a structure that helps you manage your income efficiently while enjoying your new car.

Every vehicle financed under this scheme must be comprehensively insured through FBN Insurance Brokers, while credit life insurance protects you throughout the loan period.

These two layers of protection ensure that both you and your car stay covered against unexpected risks.

Requirements for Application

To apply for the FirstBank Auto Loan, you’ll need to:

- Complete the Auto Loan Application Form

- Provide a Proforma Invoice from a FirstBank-approved vendor

- Submit a valid ID such as a Driver’s License, International Passport, or National ID Card

- Attach a Letter of Irrevocable Domiciliation of Salary for the loan duration

Once your documents are ready, visit the nearest FirstBank branch to submit your application.

FirstBank’s Automobile Loan gives you a smart way to finance a new car with ease, security, and peace of mind.

If you’ve been waiting to upgrade your ride, this is the perfect opportunity to make it happen without breaking your budget.

First City Monument Bank (FCMB)

Owning a car no longer has to be a distant dream thanks to FCMB’s Standard Auto Loan.

This loan makes it easy to drive your dream car today and spread your payments conveniently over time.

With flexible repayment terms, competitive rates, and zero hidden charges, FCMB gives you the financial freedom to own a vehicle that fits your lifestyle and budget.

The FCMB Standard Auto Loan is a consumer credit scheme designed to help individuals part-finance the purchase of vehicles for personal use.

You can buy a car from any FCMB-accredited auto dealer who has signed a service agreement with the bank, ensuring that you get your car from a reliable, trusted source.

You can borrow between ₦500,000 and ₦30 million, or up to ₦70 million when applying under special partnerships like FCMB x GAC Motors or FCMB x Elizade JAC Autoland Motors.

Repayment is flexible, ranging from 12 to 60 months, and you only need to contribute as little as 20% of the car’s value as equity.

The loan comes with an interest rate as low as 33.5%, no security requirement, and comprehensive car insurance for the entire loan period.

FCMB also includes insurance payments in your monthly repayment, so you enjoy complete convenience without worrying about extra costs.

Benefits of FCMB Auto Loan

- Free vehicle tracking device for cars valued at ₦3 million and above

- Buy from a list of accredited dealers offering safe, verified vehicles

- No residual cost at the end of the loan

- Competitive pricing with no hidden charges

- Free registration, first-year service, and car accessories like fire extinguishers and foot mats

- Five-year or 150,000 km warranty

- FREE ₦600,000 fuel voucher with select car models

- First check and service completely free

Who Can Apply

- Individuals in structured employment with verifiable income

- Self-employed professionals with regular cash flow

Special Partnerships

Through partnerships with GAC Motors and Elizade JAC Autoland Motors, FCMB offers extended repayment plans of up to 60 months, competitive interest rates, and exciting rewards like ₦600,000 free fuel vouchers, free car registration, and free first-year service.

How to Apply

Applying is quick and convenient. You can start online by clicking the “Apply Now” or “Sign Up” button on the FCMB Auto Loan page, fill out the application form, and follow the prompts.

For faster processing, visit any FCMB branch near you to apply in person.

Stanbic IBTC Bank

Stanbic IBTC Bank’s Vehicle and Asset Finance (VAF) is also another bank that makes buying a new or used car simple, flexible, and affordable.

Stanbic IBTC VAF is designed for individuals in paid employment and professionals with steady income.

The product allows you to finance your dream vehicle and spread repayment comfortably over time.

With VAF, you can choose from a wide range of bank-approved dealers and vendors, ensuring that every car purchase meets top quality and authenticity standards.

The bank finances both brand-new and used vehicles, giving you the freedom to select what best fits your budget and lifestyle.

Key Features

- Finance both new and used cars through approved dealers.

- Tenor up to 5 years (60 months) for car loans, allowing you to spread payments conveniently.

- Equity contribution as low as 10% of the asset value, one of the lowest in the auto loan space

- Competitive interest rates that help you manage your repayment without stress.

- Monthly electronic statements so you can track repayments and loan progress.

- Only vehicles from Stanbic IBTC-approved dealers qualify for financing.

Eligibility and Requirements

For you to qualify for the Stanbic IBTC Vehicle and Asset Finance, you must:

- Maintain a salaried account with Stanbic IBTC Bank.

- Provide proof of income or salary evidence to show repayment ability.

- Present a Proforma Invoice from an approved or partner dealer (preferably from Stanbic IBTC’s vendor list).

- Complete the VAF Application Form and attach all required documents.

However, according to them, used vehicles older than 20 years or with mileage above 120,000 km are not eligible for financing under the VAF scheme.

How to Apply

Applying for the Stanbic IBTC Vehicle and Asset Finance is straightforward:

- Obtain and complete the Vehicle and Asset Finance application form.

- Attach all necessary documents, including proof of income and the dealer’s proforma invoice.

- Submit your application via email to StanbicNigeria-VAF@stanbicibtc.com or drop it off at any Stanbic IBTC branch near you.

Why Stanbic IBTC stands out in the car loan scheme is their low equity requirements together with long repayment tenor which make vehicle ownership simple and stress-free.

Sterling Bank

Sterling Bank’s Vehicle & Asset Finance (VAF) is another straightforward way to own a car in Nigeria without emptying your bank account.

It is one of the most flexible auto loan options available today. The bank offers competitive rates, quick approvals, and structured repayment plans that make car ownership both easy and financially manageable.

With Sterling Bank’s Auto Loan, you can finance brand-new or fairly used vehicles from trusted vendors approved by the bank.

The process is fast, transparent, and designed to help you drive away in your preferred car in no time.

Key Features of Sterling Bank Car Loan

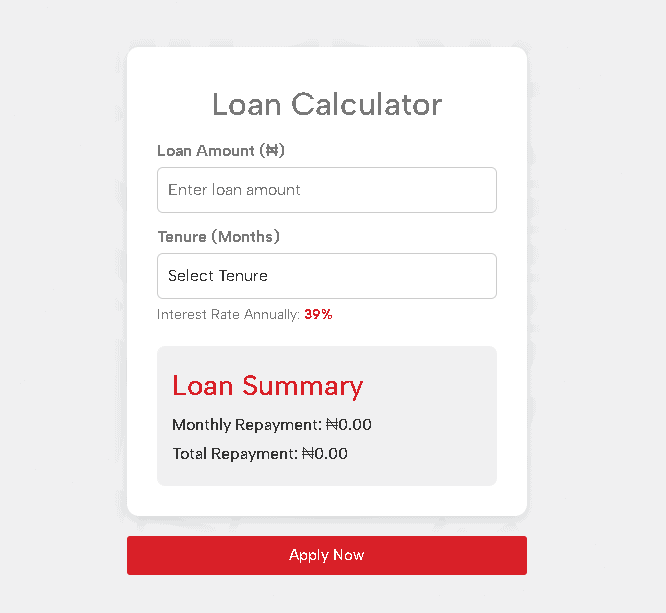

Sterling Bank offers up to ₦60 million in financing for brand-new cars and ₦40 million for used vehicles.

The repayment period extends up to 48 months for new cars and 36 months for used ones, giving borrowers enough flexibility to spread out payments comfortably.

Applicants are required to make an equity contribution of 20% for new vehicles and 30% for used cars.

The loan carries an interest rate of 39% per annum, which Sterling notes is subject to periodic market review.

A comprehensive insurance policy is mandatory for the entire loan duration, with Sterling Bank listed as the first loss payee to protect both parties in case of unforeseen events.

Sterling also highlights its fast approval and disbursement process, made possible through its established network of verified employers and accredited auto dealers.

Borrowers enjoy the option of early repayment as well, allowing them to clear their outstanding balance at any time without penalty.

Who Can Apply

This loan is designed for confirmed salaried employees whose salaries are domiciled with Sterling Bank.

To qualify, you must have received at least two consecutive months’ salary into your Sterling account and meet the bank’s standard credit requirements.

Required Documents

To apply, you’ll need to provide:

- A valid means of identification (National ID, Passport, or Driver’s License)

- Proof of employment (Offer letter or Confirmation letter)

- Last three months’ payslips

- Invoice from an approved vendor

- 12-month bank statement (Sterling or other banks)

- Equity contribution of 20–30%

- Favorable credit reports from CRC, CBN, or FC

- Proof of insurance coverage (must remain valid throughout the loan period)

Once approved, Sterling Bank pays the vendor directly after all documents have been verified, ensuring a seamless and secure transaction between you, the bank, and the dealer.

You can begin your application process by filling out the form on sterling vehicle asset finance application page,

Wema Bank

Wema Bank auto loan is another program that get you to your dream car faster through its CIG Car Loan under the Asset Acquisition Scheme.

The program is available for salaried employee, self-employed professionals, or anyone who is part of an association and earns their living from it.

Wema Bank’s flexible vehicle finance options are designed to get you behind the wheel without the financial strain.

You can secure funding of up to ₦50 million, with competitive terms that cover brand-new, Tokunbo, and pre-owned vehicles.

The loan runs on an interest rate of about 36% per annum, plus a 1% flat management fee.

Depending on the vehicle’s age, customers can make an equity contribution of 20% for cars under five years old and 30% for older models.

For new vehicles, Wema offers up to 48 months repayment tenor, and 36 months for used cars so you can spread your payments comfortably.

The bank also promises manageable monthly installments, with car ownership possible for as low as ₦195,000 per month, depending on the vehicle choice and loan size.

One standout feature is the “Easy Buy Finance” scheme, launched in partnership with Choice International Group (CIG) Motors.

This special offer allows customers to buy GAC Motors vehicles such as the GS3, GS4, and GS8 SUVs with just 10% equity contribution, up to 48 months repayment, and even a 15% discount off current market prices.

This facility is open exclusively to Wema Bank’s salary, savings, and current account holders, making it ideal for individuals, corporate bodies, and organizations looking for a convenient path to vehicle ownership.

Applying is easy, you can start by clicking the “Indicate Interest” button on Wema Bank’s x CIG car loan page or visiting any of their branches nationwide for rapid processing and approval.

With Wema Bank’s Auto Loan, upgrading or owning your first car is no longer a dream.

Polaris Bank

Polaris Bank’s Auto Loan Scheme is tailored for Nigerians who want to own a brand-new car without the financial burden of paying upfront.

Be you salaried or self-employed, Polaris makes it easy to drive your dream vehicle while spreading payments conveniently over time.

The bank’s auto financing plan provides enough flexibility to suit diverse income levels with a loan amount of up to ₦40 million and a tenor of up to 48 months.

Borrowers can make an equity contribution as low as 10% of the vehicle cost, which makes car ownership more accessible than ever.

The loan is open to both Polaris and non-Polaris Bank customers, provided they have a verifiable source of income.

Polaris goes beyond standard auto loans by partnering with reputable car brands to offer specialized financing packages with unbeatable perks.

Polaris x GAC Motors – Premium Cars, Flexible Payment

Through its partnership with GAC Motors, Polaris Bank offers financing for top-tier models such as the GA4, GS3, GS4, GS8, and GN8.

Customers enjoy 0% interest for the first four months and 25% per annum thereafter, with a management fee of 1% and no equity contribution required.

The scheme runs for up to 60 months, leveraging GAC’s five-year warranty, and includes enticing benefits such as:

- Free car registration

- GAC Motor gift box/starter kit

- First free service at 5,000 km or 3 months

- Dedicated after-sales advisors and mobile servicing via GAC Fast Care

This makes it a premium yet affordable option for professionals seeking both comfort and convenience in one package.

Polaris x Elizade JAC Motors – Smart Options for Every Lifestyle

Polaris also partners with Elizade JAC Motors to provide flexible financing on models like the JS3 Luxury, JS4 Flagship, J7 Luxury, JS6, and the T8 Pro pickup.

The offer mirrors the GAC partnership with 0% interest for the first 4 months and 25% per annum thereafter, plus a 1% management fee and zero equity contribution.

Borrowers enjoy up to 60 months repayment, a five-year or 150,000 km warranty, and impressive extras such as:

- Free car registration

- Free first check and one-year service

- Driver training on vehicle maintenance

- Free accessories, including fire extinguisher and foot mats

Polaris Bank’s collaborations with GAC and JAC Motors make it one of the most customer-friendly auto loan providers in Nigeria, combining flexible financing, extended warranties, and genuine value-added benefits.

Applying is straightforward, simply click “Apply Here” on the Polaris Car Loan page to fill out the online form, or download and submit it physically at any Polaris branch for faster processing and approval.

United Bank for Africa (UBA)

While UBA Bank doesn’t offer a dedicated auto loan product, the bank makes it clear that you can still get the financial support you need to buy a car through its broader consumer loan programs.

On their website, UBA invites customers to “Fuel Your Ambitions” for starting a side hustle, buying a new car, or handling emergencies.

If you’re a salary earner with a steady income, UBA’s Personal Loan is a practical alternative to fund your vehicle purchase.

The product is built to give employed individuals quick access to cash for their goals like buying a car, paying bills, or improving their lifestyle, without the need for a special auto financing product.

With UBA’s Personal Loan, you can borrow up to ₦30 million with a repayment period of up to 60 months.

The loan attracts a one-time management fee of 1%, and the interest rate is highly competitive compared to other salary-backed loans in Nigeria.

Borrowers can also access up to 60% of their debt service ratio (DSR), making it suitable for high-income earners who want to finance a vehicle purchase outright.

To qualify, you’ll need an active UBA savings or current salary account, a valid means of identification, a completed loan application form, and proof of employment such as a verified offer letter or employee inquiry form.

Once approved, funds are disbursed directly into your salary account, ready to be used for your car purchase or any other financial goal.

For customers who prefer a more personal approach, visiting any UBA branch is encouraged.

Bank officers can guide you through the eligibility process and may even structure a customized financing plan for the purcchase of your dream car, especially if you have a consistent income and good credit standing.

So while UBA might not label it as an “auto loan,” their Personal Loan still provides a reliable path to vehicle ownership, giving you the liquidity to buy your car today and repay conveniently over time.

How to Pick the Best Car Loan Bank for You

Choosing the right bank for your car loan in Nigeria can make a huge difference in how much you pay in the long run and how seamless your financing experience will be.

While many commercial banks now provide auto loan and car financing solutions, their terms vary widely in interest rate, repayment flexibility, documentation, and even the type of cars they finance.

To finance your dream car without regrets, you need to look beyond the headlines and assess what really matters like interest rate per annum, loan tenor, down payment, and whether the bank finances new or used cars.

Here’s a professional breakdown of how to identify the best auto financing option for your unique situation based on your income type, credit profile, and vehicle preference so you can make a financially smart move.

1. Interest Rate vs Effective Cost

Don’t get carried away by the advertised interest rate alone. The real cost of your loan often hides in the details such as management fees, insurance bundling, legal charges, prepayment penalties, and default fees.

For instance, a 36% per annum offer with multiple hidden fees may end up being costlier than a 39% flat-rate loan with no extras.

So it’s best to ask for the Annual Percentage Rate (APR) or a full cost breakdown before signing.

2. Equity / Down Payment

Equity contribution which simply means your initial down payment, directly affects both your borrowing amount and your overall financial risk.

A bank that requires just 10% equity may seem attractive compared to one demanding 30%, but lower equity often comes with higher interest rates or stricter approval terms.

Choose an equity ratio that balances accessibility with affordability, ensuring you don’t overextend or strain yourself financially during repayment.

3. Tenor / Repayment Period

The repayment tenor determines your monthly installment and total interest cost. Longer tenors (48–60 months) reduce your monthly burden but increase how much you pay overall.

Shorter tenors (12–24 months) save you interest but require stronger cash flow.

Pick a tenor that works with your income stability and other financial obligations because comfort in repayment is key to maintaining good credit health.

4. Approved Vendors & Dealers

Most Nigerian banks only finance vehicles purchased from their list of approved dealers.

This policy protects you from counterfeit or stolen cars and guarantees vehicle quality.

However, it limits flexibility, meaning you might not be able to buy from your preferred seller since some of the approved vendors use this opportunity to sell at slightly higher cost.

You can always review the bank’s dealer list and check if your desired brand or model is available before applying.

5. Insurance & Tracking Requirements

Banks almost always require comprehensive car insurance, and for high-value vehicles, a tracking device may be mandatory.

These requirements safeguard both you and the lender but add to your upfront cost.

Make sure to include insurance and tracker fees when comparing total loan costs between banks, as they can significantly influence the effective price of financing.

6. Creditworthiness, Salary Domiciliation & Documentation

Your financial profile plays a huge role in loan approval. A steady income stream, clean credit history, and willingness to domicile your salary with the bank greatly improve your chances.

Before applying, gather all required documents like your payslips (usually last 3–6 months), bank statements, valid ID, proof of employment or business registration, and a proforma invoice from the right dealer.

A complete, organized submission often fast-tracks approval.

7. New vs. Used Cars

Not all banks finance used cars, and among those that do, conditions vary widely.

Some banks restrict the age of used cars to under five years, while others may require inspection reports or higher equity.

If you plan to finance a used car, confirm the bank’s policy early on to avoid rejection or hidden costs.

While used cars reduce your upfront burden, they often attract shorter tenors and higher rates due to depreciation risks.